Direct Pay for Vendors

PayKeeper protects all parties

Solar

Solar projects have multiple stakeholders from sales dealers and reps, materials distributors, manufacturers, subcontractors, and other vendors. Having the funds on the project go to the contractor first burdens them with the task of paying all of these parties. Credit accounts need to be procured to allow for the services and materials to be procured before payment is received by the contractor, putting financial stress squarely on their shoulders. What results is more admin work by the contractor, and enormous risk by all the stakeholders when a contractor finds themselves in financial trouble, or even goes out of business. PayKeeper can stand in the middle and hold the project funds as a licensed escrow company, and its innovative platform can configure milestones and payments to go directly to these various stakeholders, eliminating contractor risk and reducing contractor overhead.

Roofing

Roofers face complex payment arrangements, especially with some funds coming from insurance companies, some from consumers, and also needing mortgage company approval. Payment timelines and AR can balloon for a roofing contractor, putting at risk the essential relationships, like materials suppliers and labor subcontractors that keep them moving and installing. By utilizing PayKeeper’s direct pay platform, we can facilitate materials payments securely, avoiding the need for credit terms, making sure AP and AR timelines match. Because of the security of being paid from escrow accounts, most material suppliers do not require up front payments or large deposits to secure products - even those with long back order delays. Direct Pay is essential to lower payment risk for vendors, and at the same time smoothing out AP and AR timelines for contractors, giving them unlimited buying power, and reducing admin costs.

Home Improvement

The financial management of home improvement and remodel jobs can be difficult for contractors to manage. It is not uncommon to have more than a dozen vendors on a simple remodel job. PayKeeper can organize and align payment terms to all vendors, while reducing payment risk for their AR. PayKeeper’s Direct Pay platform can provide contractors with job cost accounting, custom milestones for multi phase projects, as well as unlimited buying power since procurement does not need to be placed on credit lines. Consumers are always nervous that their money will be spent on their own job. PayKeeper’s Direct Pay platform ensures that disbursements are made to vendors on their own project, when milestones are met.

Commercial Construction

Using PayKeeper’s Direct Pay platform to pay subcontractors and vendors directly rather than routing funds through the contractor reduces financial risk by ensuring that payments are made promptly and transparently, minimizing the chance of misappropriation or diversion of funds. Direct Pay helps prevent scenarios where a contractor might delay or withhold payments, leading to potential liens, project delays, or disputes. It also provides greater financial oversight, ensuring that funds are used solely for their intended purpose, thereby protecting the interests of the owner, lender, and all stakeholders involved in the project. Additionally, it reduces the risk of contractor insolvency affecting payments, as subcontractors and vendors receive their compensation directly, maintaining steady workflow and supplier relationships.

Sales commissions

Direct Pay enables sales commissions to be deposited into an escrow account and released upon project milestone completion - providing sales reps with financial security and transparency eliminating payment risk altogether. This approach safeguards their earnings by preventing payment delays, by automating a process for disputes, and PayKeeper’s wallet functionality can even secure collateral funds to further protect both sides. It also offers peace of mind, reducing reliance on the company’s cash flow stability or potential financial issues. Additionally, this system fosters accountability at the point of the sale, ensuring that both the sales team and company remain aligned on selling quality deals. By guaranteeing commission payouts based on measurable progress, sales reps can confidently focus on driving business growth without concerns about payment reliability.

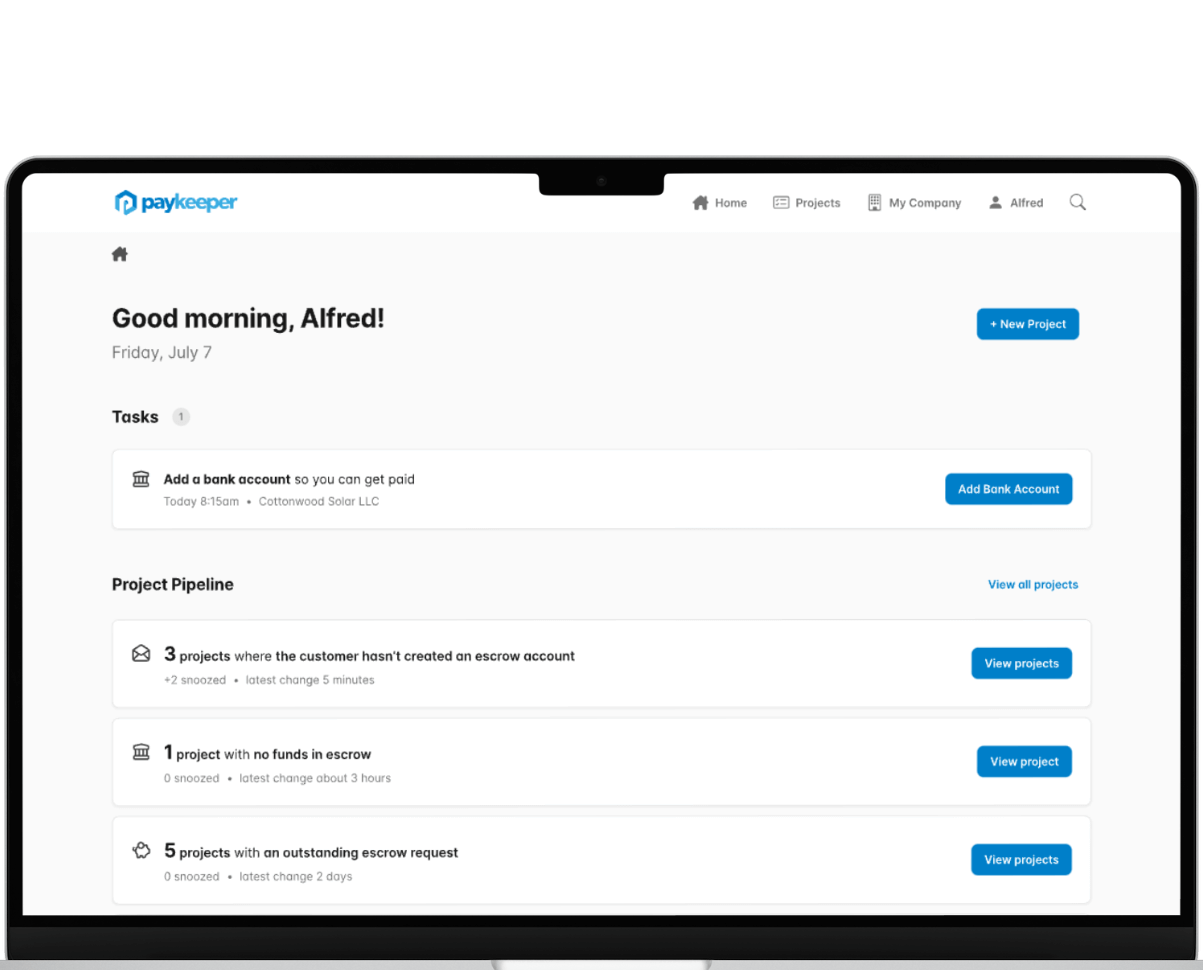

The PayKeeper Way

See how escrow is revolutionizing these industries

Home Improvement

Roofing, windows, kitchen & bath, landscaping, HVAC, remodeling.

Solar

The best and most reputable residential and commercial installers use PayKeeper.

Private Party Purchases

When you buy or sell something online, protect your transaction through PayKeeper.

Other industries

Contract work, import/export, commissions, commercial construction.